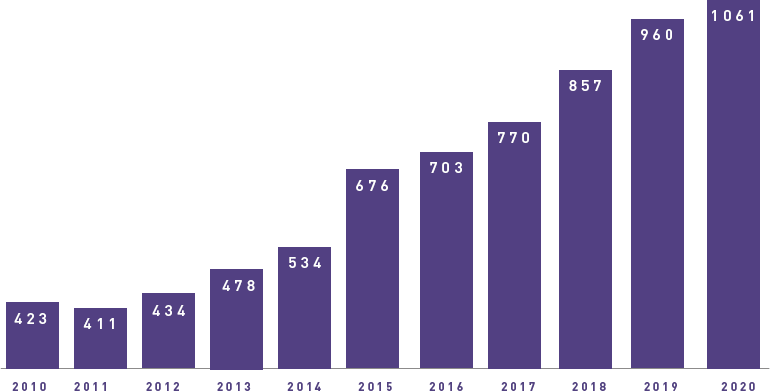

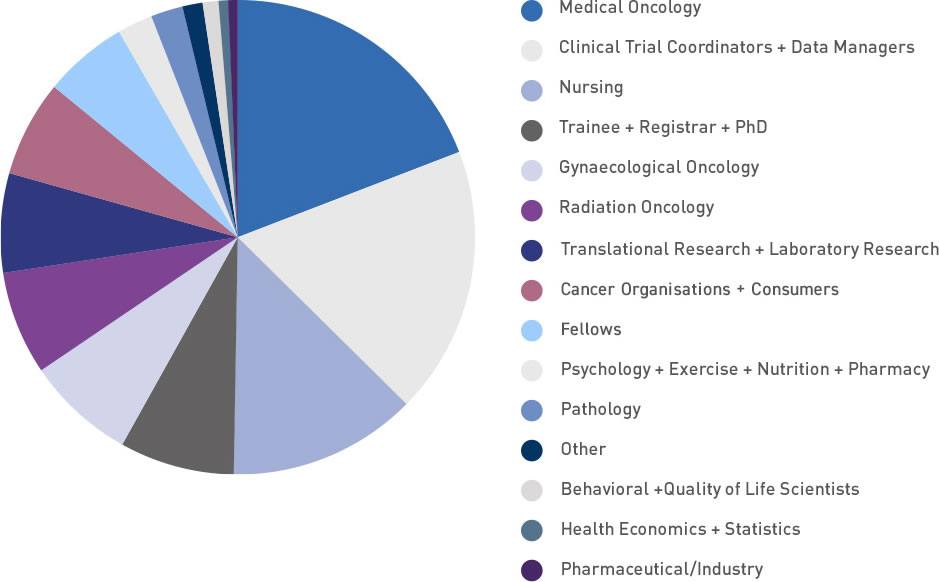

Our membership has grown significantly since our organisation was founded in 2000, doubling in the last seven years to over 1,000. ANZGOG's members in every Australian state and New Zealand and are dedicated to growing the research portfolio in both treatment, surgery, radiation oncology, quality of life and survivorship. Together with our staff, donors and partners, our members work to improve life for women through cancer research.

ANZGOG regularly reviews its performance against the five strategic goals, in the areas of: